User Story: How Money Eva Guided Our Decision on a New Construction Deal

As the creator of Money Eva, I’ve had the chance to truly test its power—and it’s been a game-changer for our financial decisions. Recently, my wife found an incredible deal on a new construction property, but with Money Eva’s insights, we made the surprising call to walk away. Within minutes, it helped us see the full picture and make a confident decision. Here’s how!

Q: What initially caught your attention about this property?

A: My wife discovered this property, and we both saw huge potential right away. The numbers were compelling: we’d be stepping into profit as soon as the build was completed, and the opportunity was exclusive—a three-day pre-sale event.

At $670,000 plus 15% in taxes, this newly built townhouse was in a prime location and could likely flip for over $800,000 or more. That kind of profit was definitely appealing, but I knew I wanted to run it through Money Eva to make sure it was the right move.

Q: What were the main financial questions you wanted to answer?

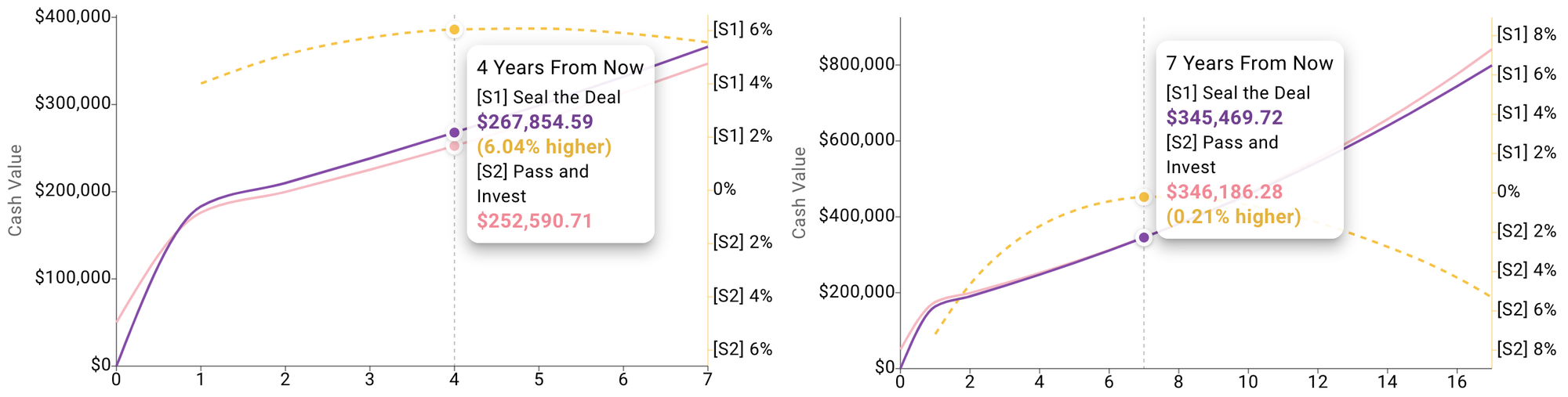

A: The big question was whether to invest in this new property, or keep our money in the market. We needed to compare the potential returns of flipping, renting, and leaving our money where it was.

Q: How did Money Eva help you dive into the numbers?

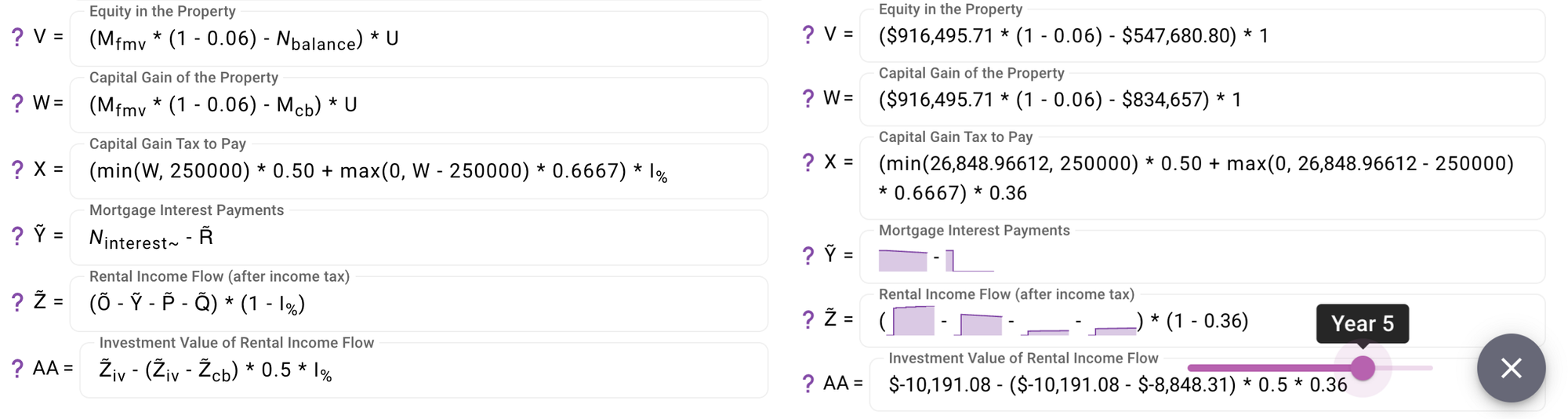

A: There were so many numbers to work through, from initial deposits to long-term costs. The contract required a $50,000 deposit and a total of 20% down payment at closing. We’d also need to factor in Quebec’s Welcome Tax (a title registration tax), plus municipal and school taxes. On top of that, we’d be taking out an 80% mortgage, where interest would be tax-deductible on rental income but not principal payments.

And, of course, selling would mean accounting for vacancy periods, staging, and broker commissions—all of which increase over time, ideally along with inflation.

Money Eva made it easy to line up these cash flows across different timelines. The app’s “number-revealer” button helped us confirm all calculations, giving both of us confidence that nothing was overlooked. This feature was key—it’s designed to make sure every calculation is spot on, keeping it simple with just basic math. It was practically foolproof!

Q: Were there any surprising insights?

A: Definitely. The negotiation factor was a huge eye-opener—if we had to knock off just $20,000 from the sale price, it would instantly turn this deal from a profitable 4-6% gain into something barely worth pursuing. And at this price point, a $20k discount isn’t unusual.

Money Eva helped us see this risk clearly, especially since this investment would impact our asset diversification and require time to oversee construction and manage tenants.

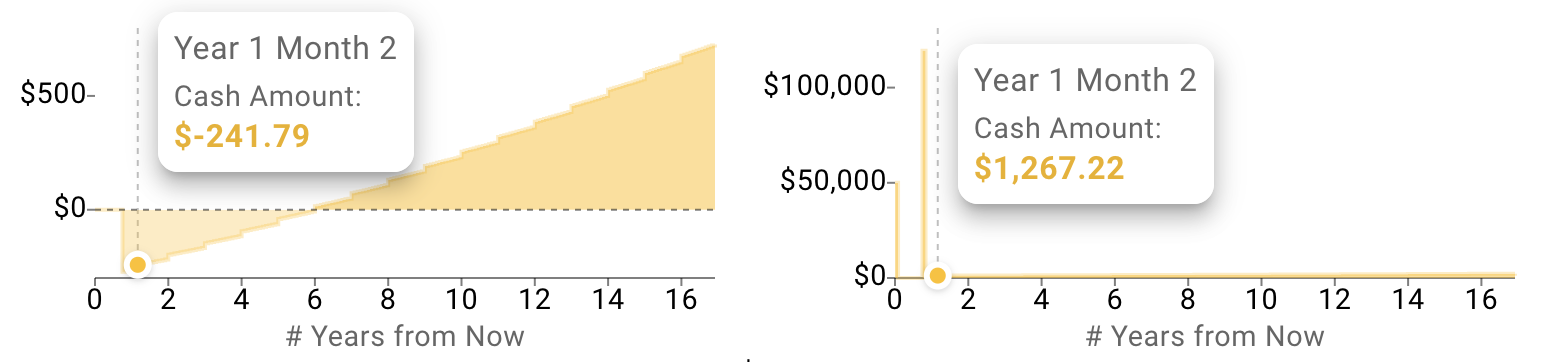

We also realized a potential cash flow strain by examining each cash flow through Money Eva’s “?” buttons. At the expected market rent, we’d be facing about a $250 monthly rental loss after taxes, plus an additional $1,300 in mortgage principal each month. Combined with the 20% down payment, this put our family finances under stress—balancing this would be tough on our other financial priorities and overall peace at home.

Q: What was the final decision you reached?

A: With all the numbers laid out, it was clear we should walk away. And it wasn’t just my decision—it was a consensus we both felt confident about. Money Eva took what could have been a speculative, almost FOMO-driven choice, and turned it into a solid decision with no second-guessing since.

Q: What makes Money Eva useful for others facing similar decisions?

A: Ideas aren’t apples—you share them, and they multiply. I’ve made my own Money Eva scenario available through the link below, or you can find it in the search box if you prefer. It’s perfect for anyone who wants to make informed, confident choices in complex financial situations. For us, it gave us clarity, confidence, and peace of mind, and I hope you’ll find it just as useful!