Should You Buy or Sell Investment Property in 2025? A Visual Guide to Navigating Market Volatility

As 2025 approaches, the real estate market anticipates shifts driven by economic trends, interest rates, and investor sentiment. Here, we'll dissect these forecasts and use Money Eva's visualizations to give you a clear picture of how these shifts could influence your investment decisions.

1. Interest Rates: The Heartbeat of Real Estate Decisions

Interest rates are pivotal in shaping the real estate market, affecting both buying decisions and investment returns. Here's the anticipated impact for 2025:

- US Perspective:

- The Federal Reserve might tweak rates in response to inflationary pressures, with forecasts suggesting a potential dip below 6% for 30-year fixed mortgages by the end of the year. This lowering of borrowing costs could make real estate a more attractive investment, spurring both home buying and property investment activities.

- Canada's Outlook:

- After experiencing a period of elevated rates, Canada's interest rates are expected to see a decline, possibly settling around 5% for 5-year fixed mortgages. This could stimulate the housing market by making loans more affordable. However, the high cost of living might temper the enthusiasm for investment, as potential buyers weigh the benefits against the backdrop of general living expenses.

With Money Eva's live visualizations, you can clearly see how these rate changes will shape your investment strategy, pinpointing optimal times to buy or sell based on their impact on profitability. Here's a look at the scenarios:

2. Property Price Trends: Boom or Correction?

The trajectory of property prices in 2025 will determine if it's a time for celebration or caution:

- US Market Forecast:

- The consensus among analysts leans towards a stabilization rather than significant growth, with home prices expected to increase by 2-5%. This moderate rise reflects a market cooling down from previous years' rapid increases, potentially offering a more balanced environment for both buyers and investors.

- Canadian Market Insights:

- Following years of substantial price hikes, Canada might see a correction in 2025, with growth rates expected to slow to 1-3%. This adjustment could be influenced by policies aimed at increasing housing supply and addressing affordability, providing opportunities for investors as prices might become more aligned with income levels.

- Regional Variations and Market Correction Indicators:

- Both nations will see regional disparities, where economic factors like job growth or population shifts influence local markets.

- For example, in the US, Austin might continue to see robust price increases due to tech industry expansion, while Detroit could stabilize or even decrease, reflecting slower economic recovery.

- In Canada, Vancouver's prices might level off due to policy interventions, whereas Calgary could see a mild uptick with energy sector recovery.

- Look for correction signs like increased inventory or longer market times to decide if you should invest now or wait. When opportunities arise, Money Eva can help you make strategic decisions.

- Both nations will see regional disparities, where economic factors like job growth or population shifts influence local markets.

In essence, 2025 might be about price adjustments rather than acceleration. Money Eva's visual tools will guide you in understanding when appreciation outweighs investment returns, aiding strategic decisions on when to sell.

3. Rental Market Dynamics: A Bright Spot for Investors?

The rental sector could be a silver lining in 2025's real estate landscape:

- US Rental Market:

- Even with a possible slowdown in home price appreciation, rental demand is forecasted to stay robust, fueled by demographic changes and economic conditions.

- Canadian Rental Trends:

- High barriers to homeownership and ongoing immigration could bolster Canada's rental market, keeping demand elevated.

- Supply and Demand Balance:

- In Toronto, significant new construction of rental units might help moderate rental prices, but in Vancouver, where land is scarce and development is slower, a supply shortfall could keep rental rates climbing.

- In markets like Austin, where job growth fuels population increase, landlords might see significant rent hikes, potentially pushing investment yields up to 7-8% annually, making rental properties highly lucrative.

- Long-term vs. Short-term Rentals:

- The rise of Airbnb in tourist hotspots like Miami could lead to a preference for short-term rentals, offering higher nightly rates but less predictable income compared to traditional long-term tenancies.

- Conversely, in college towns like Ann Arbor, the demand for stable, long-term rentals for students could remain strong, offering consistent returns with less fluctuation.

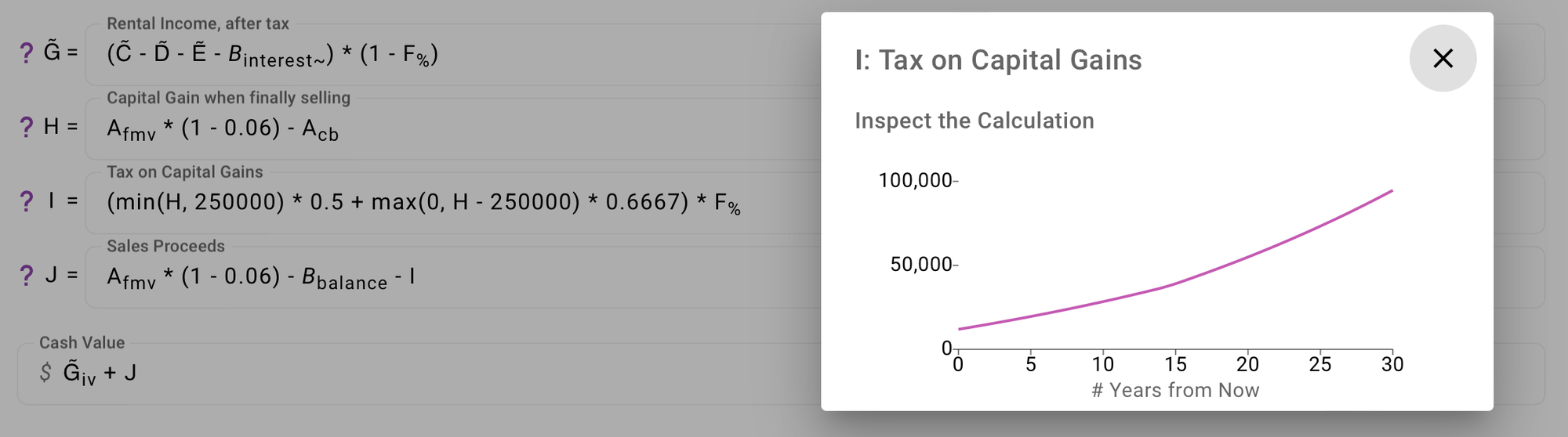

4. Tax Policy and Incentives

Navigating tax policies and incentives will be crucial for optimizing real estate investments in 2025:

- US Tax Incentives:

- Proposed measures include a $5,000 tax credit for first-time homebuyers and a $10,000 credit for selling starter homes, which could stimulate market activity by reducing entry and exit costs.

- Canadian Tax Landscape:

- Discussions around property tax reforms could introduce incentives aimed at affordable housing or promoting energy efficiency, influencing investment choices in property development or renovations.

- Capital Gains Considerations:

- Changes in long-term capital gains tax rates might encourage or deter property sales, affecting investment strategies by altering the tax implications of selling real estate.

- Depreciation Benefits:

- The potential reinstatement of 100% bonus depreciation in the US could provide a significant tax advantage for investors focusing on new builds or property improvements, enhancing cash flow through accelerated deductions.

- Policy Impact on Investment Timing:

- New or evolving tax policies could dictate the optimal timing for investing in or divesting from real estate assets, depending on how they affect tax liabilities and investment returns.

In 2025, understanding tax policies' effect on real estate is key. Money Eva's customizable equations allow you to adapt to new tax rules, showing their impact on your strategy.

Conclusion

Navigating 2025's real estate market demands insights into rates, prices, rentals, and taxes. Here's how to make it actionable:

- Make Informed Moves: Use forecasts to buy, sell, or hold wisely.

- Visualize Trends: See the big picture with Money Eva's tools.

- Stay Policy-Savvy: Adapt to tax changes for maximum benefit.

Let Money Eva integrate these insights into a cohesive strategy for your investment success in 2025.