EV vs. Gas Made Easy: A 1-2-3 Guide with Money Eva

Deciding between an electric vehicle (EV) and a gas-powered car? Long-term costs can make or break your choice. With Money Eva, creating a clear, side-by-side comparison is a breeze.

This step-by-step guide will help you evaluate the true cost of ownership for both options, so you can confidently choose the one that fits your financial goals. Let’s jump in!

Step 1: Define Your Vehicles and Comparison

Start by setting up the vehicles you want to compare. For this guide, we’ll use the Tesla Model 3 (electric) and the Toyota Camry (gas-powered). To keep things simple, we’ll assume you’re paying cash upfront. After reading this guide, you’ll know how to effortlessly convert this to a leasing or financing scenario.

Here’s what to include in your comparison:

- Purchase Price: Include taxes, dealer fees, and rebates.

- Fuel Costs: Based on your annual mileage and local costs.

- Yearly Maintenance Costs: Plus EV battery replacement costs for the Tesla.

- Investment Impact: How this purchase affects your investment account over time.

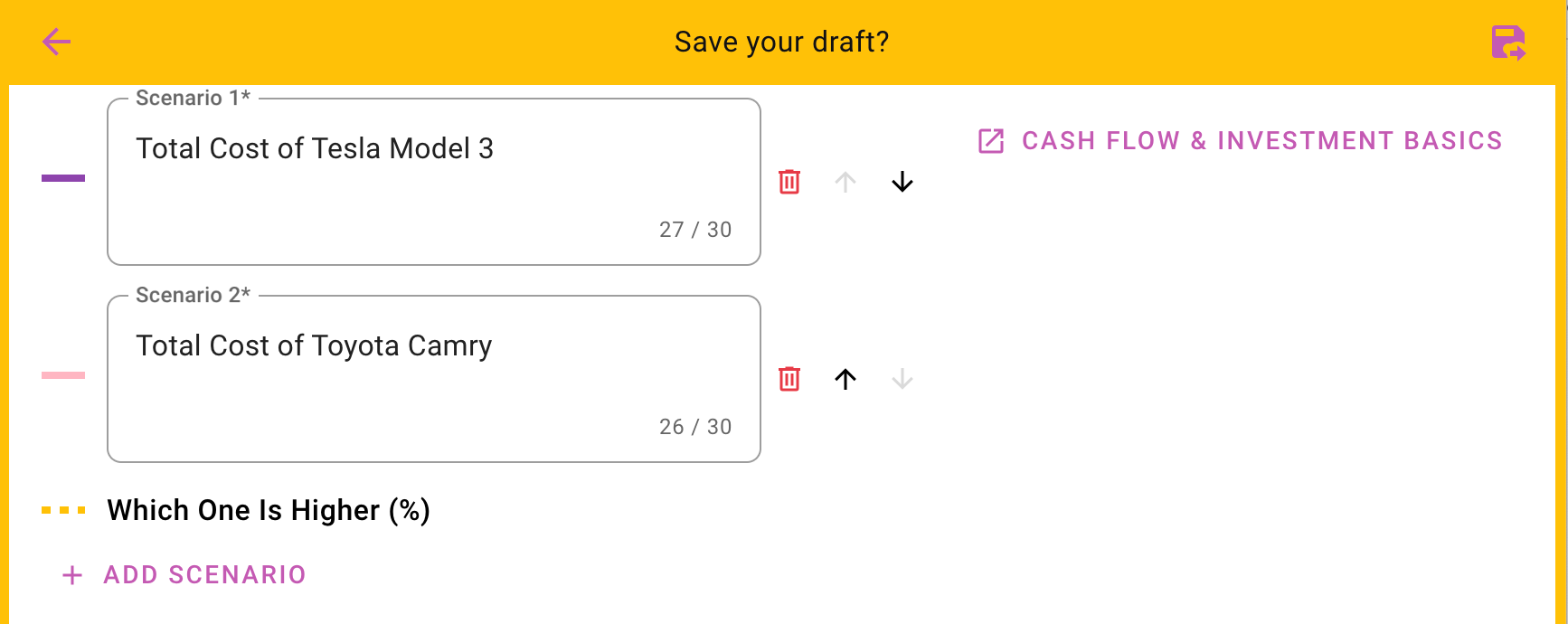

To get started in Money Eva, create a new scenario and name the two comparisons: "Total Cost of Tesla Model 3" and "Total Cost of Toyota Camry."

Now you’re all set for the next step! (And don’t forget to save your draft!)

Step 2: Add Cash Flows for Each Cost

In Money Eva, cash flows represent your spending over time. Let’s break them down into clear categories:

1) Purchase Price

After factoring in taxes, rebates, and fees:

- Tesla Model 3: $40,244

- Toyota Camry: $32,355

Enter these amounts as one-time cash flows using the "Invest" decision. This models how the upfront payment affects your investment account immediately.

2) Fuel Costs

Calculate monthly fuel costs based on driving 12,000 miles per year (1,000 miles/month):

- Toyota Camry:

Divide 1,000 miles by its fuel efficiency (33 MPG) to get ~30 gallons/month. Multiply by the gas price ($3.75/gallon) to find the monthly fuel cost. - Tesla Model 3:

For 1,000 miles, it consumes ~26 kWh per 100 miles: 26 × 10 = 260 kWh/month. Multiply by the electricity rate ($0.22/kWh) to calculate the monthly cost.

Enter these as "Monthly Cash Flows" in Money Eva. They automatically adjust for yearly inflation by default.

3) Maintenance Costs

- Toyota Camry:

Routine maintenance (e.g., oil changes, brake pads) costs ~$400/year. Add this as a recurring yearly cash flow starting in Year 1, with inflation adjustments. - Tesla Model 3:

Routine maintenance is lower, averaging ~$150/year. Add this as a yearly cash flow starting in Year 1, also with inflation adjustments.

Include battery replacement costs of ~$12,000 every 8 years. Add these as one-time cash flows (Year 8, 16, 24) using the "Expect to Invest" option, accounting for inflation.

Money Eva makes this process seamless: add recurring or one-time cash flows, set timing and growth rates, and they’ll be ready for Step 3—bringing everything together.

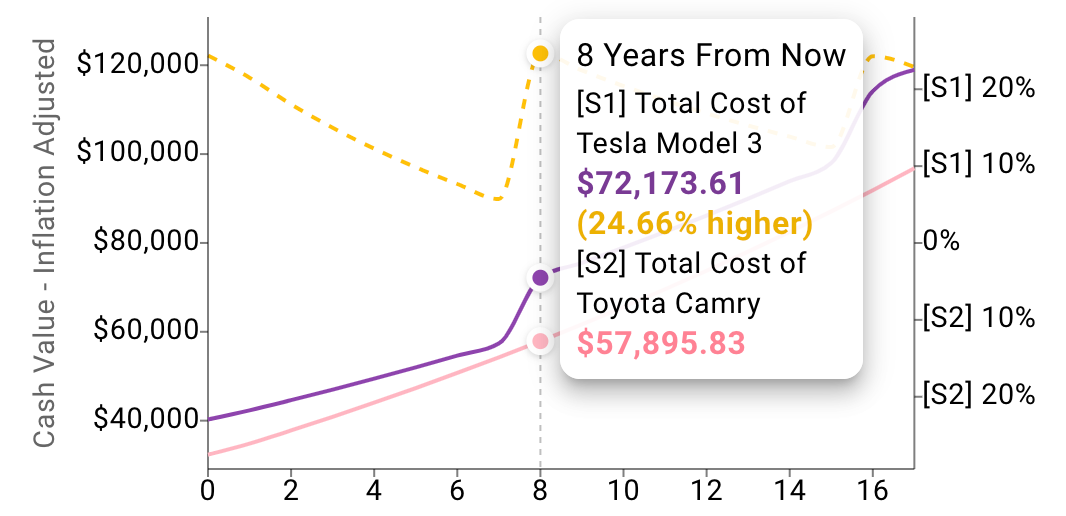

Step 3: Summing It All Up

Here’s where the magic happens. In Money Eva, you can effortlessly combine all your cash flows—purchase price, monthly fuel costs, yearly maintenance, and future battery replacement—into a single, comprehensive cash flow by simply typing "a+b+c+..." in the equation box. It’s as intuitive as typing basic math!

Next, enter the combined cash flow’s investment value (G̃ᵢᵥ) by typing "gi"—it will insert automatically—and place it into the final Cash Value equation box. And just like that—voila! Head back to the chart to see how the total cost impacts your investment over time.

Repeat the same process for the Toyota Camry, and now you can compare the total costs of the Tesla Model 3 and Toyota Camry side by side in a single, clear chart.

Extra: Make Key Factors Interactive

Want to highlight the most important factors in your scenario? With Money Eva, it’s a breeze to:

- Create inputs for key variables, like how often an EV battery needs replacing.

- Link these inputs to your scenarios for quick, real-time adjustments.

For example, let’s add an input for "Replace Tesla Battery Every (... Years)". Instead of hardcoding 8, 16, and 24 years, you can use the new variable A, A * 2, A * 3. Now, the replacement schedule is tied to your input. Best of all, this input appears right next to your chart.

Want to see the impact of changing the replacement frequency? Just update the input value and watch your chart adjust instantly—it’s that simple!

Publish Your Insights

Why keep your findings to yourself? Share your scenario with the world in just two clicks. Money Eva makes it easy to publish and collaborate on insights, helping others make informed financial decisions.

With Money Eva, creating investment scenarios is as simple as 1-2-3. Whether you’re deciding on your next car or evaluating other major financial choices, the clarity and confidence Money Eva provides are just a few steps away. Try it out today!