4 Reasons Your Early Retirement (FIRE) Plan Might Not Work Out

Dreaming of retiring early? Many people are inspired by the promise of financial independence, retiring early (FIRE), and spending their time on passion projects or travel. While these goals are achievable, planning for early retirement comes with unique challenges that can derail an ambitious plan. Here are four key reasons your early retirement plan might not work out and how to avoid them.

1. Inflation’s Stronger Impact on Shortening Your Retirement Fund’s Lifespan

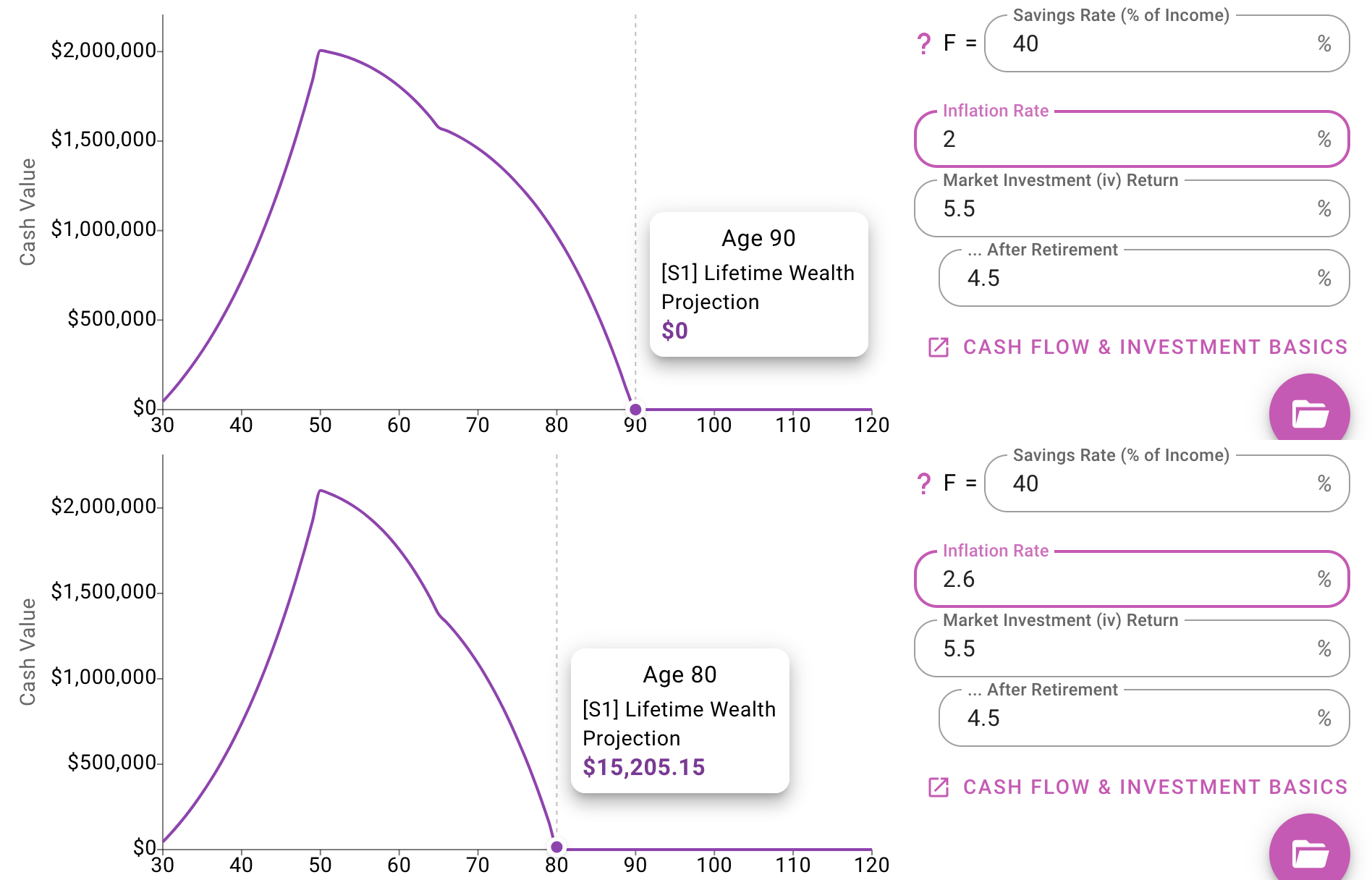

One of the most underestimated risks in retirement planning is inflation. Inflation measures how quickly money loses purchasing power over time. Central banks aim to keep it under 2% for a healthy economy because moderate inflation encourages spending and borrowing, which drive economic growth. However, socio-economic events can disrupt this balance, leading to periods of hyperinflation that take years to stabilize.

Throughout your working life, earnings and expenses typically adjust to inflation, and tax brackets and benefit limits are often indexed accordingly. However, in retirement, you rely on investment returns to outpace rising expenses. This makes the inflation rate a critical factor in determining how long your savings will last.

For instance, our previous blog post showed that increasing the inflation rate from 2% to 3% could shorten a traditional retirement by 10 years. In an early retirement scenario at age 50, even a smaller inflation bump from 2% to 2.6% could have the same 10-year impact on your savings.

What to do: Plan conservatively by assuming a higher long-term inflation rate than 2%. Use financial tools that allow you to model varying inflation scenarios over extended periods.

2. Reduced Pension Benefits and Limited Tax-Deferred Savings

Early retirement means fewer years of contributing to pension plans and tax-advantaged accounts. In Canada, for example, the Canada Pension Plan (CPP) bases benefits on your highest-earning years. Retiring early reduces both your contributions and your ultimate payout.

Similarly, tax-deferred accounts like RRSPs (Registered Retirement Savings Plans) in Canada or 401(k)s in the United States have annual contribution limits tied to your income. Shortened working years result in fewer contributions, leaving a larger portion of your savings exposed to immediate taxation.

The dual impact makes it harder to build a nest egg for early retirement while also depleting savings faster throughout retirement, even past regular retirement age. Unfortunately, one-size-fits-all retirement calculators often overlook this challenge when it comes to evaluating FIRE.

| Country | Plan | Contribution Limit (2024) | Limit Basis | Key Details |

|---|---|---|---|---|

| Canada | RRSP (Registered Retirement Savings Plan) | 18% of prior year's earned income, up to CAD $31,560 (indexed annually) | Previous year’s earned income and a government-set cap | Unused contribution room can carry forward indefinitely. |

| US | 401(k) | USD $23,000 (for participants under 50), USD $30,000 (for 50 and older) | Fixed annual limit, with "catch-up" contribution for age 50+ | Employer match does not count toward the individual contribution limit but has a combined cap. |

| US | IRA (Traditional and Roth) | USD $6,500 (under 50), USD $7,500 (for 50 and older) | Fixed annual contribution limit | Roth IRA has income-based eligibility limits. |

| UK | SIPP (Self-Invested Personal Pension) | GBP £60,000 or 100% of relevant income (whichever is lower) | Annual limit indexed by inflation | Unused allowances can carry forward for up to 3 years. |

| Australia | Superannuation | AUD $27,500 (concessional) | Fixed concessional limit | Non-concessional limits (after-tax contributions) have separate annual and lifetime limits. |

| Germany | Riester Pension | EUR €2,100 (including government bonuses) | Fixed annual limit | Contributions are eligible for government subsidies and tax deductions. |

| France | PER (Plan Épargne Retraite) | 10% of annual income up to 8 times the social security ceiling (approx. EUR €35,000) | Based on income and a capped multiple of the social security limit | Contributions can be deducted from taxable income within limits. |

What to do: Consider phased retirement or part-time work to continue accruing pension credits and maximizing tax-advantaged contributions. When calculating your early retirement plan, factor in reduced pension payouts and a lower proportion of tax-deferred savings. Use customizable financial tools like Money Eva to adjust these variables accurately.

3. Insufficient Diversification in Investments

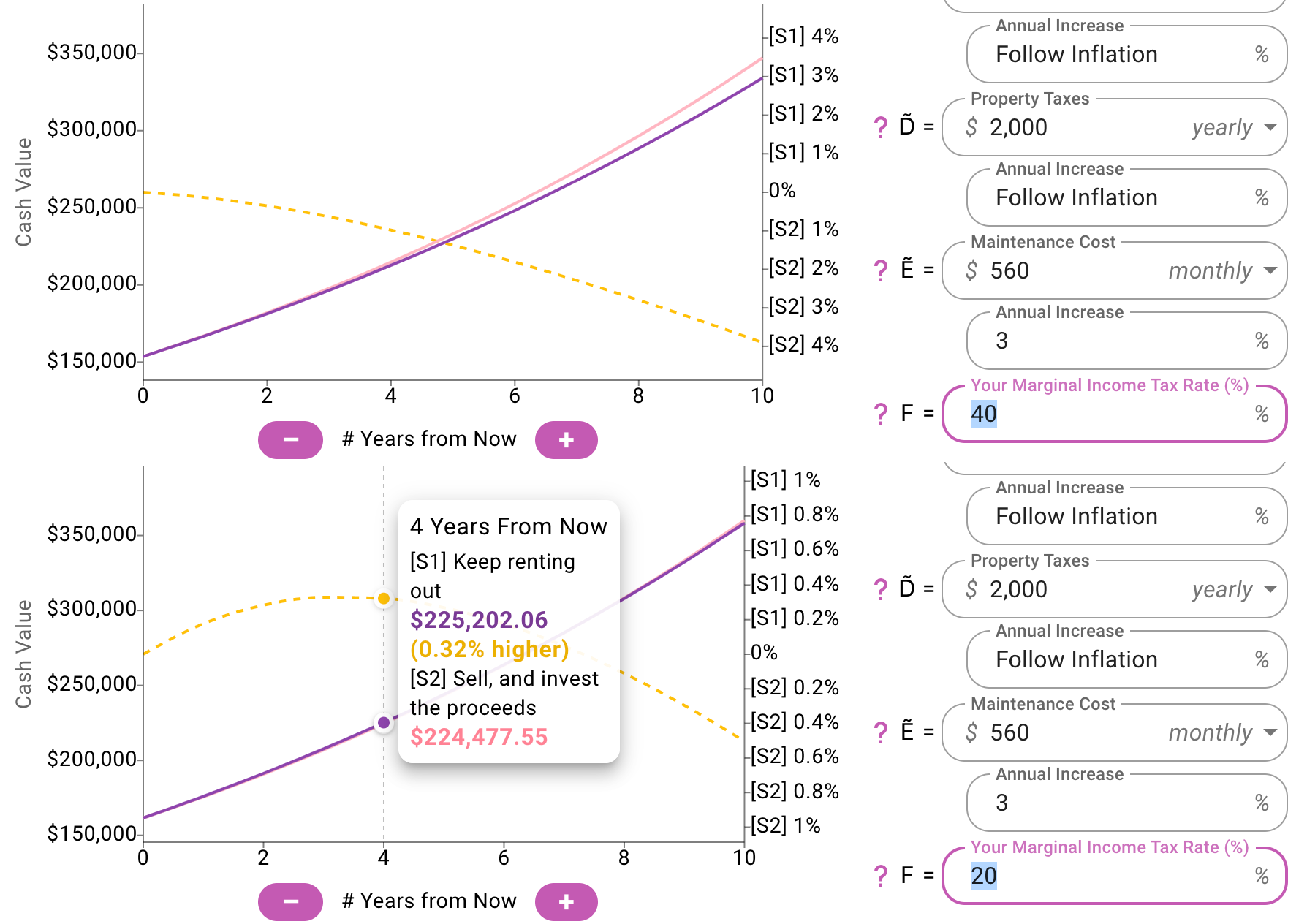

Many early retirees rely on stock-heavy ETF portfolios or a single source of passive income, like real estate. However, concentrated investments increase your vulnerability to market downturns, unexpected expenses, or underperformance.

Proper diversification means spreading your investments across large-cap, mid-cap, and small-cap stocks, bonds, real estate, and other alternatives like REITs or private equity. A balanced portfolio reduces exposure to individual risks while optimizing returns over time.

Diversification also allows you to strategically withdraw from better-performing assets, avoiding losses by selling undervalued holdings. Additionally, leverage-based assets, such as real estate, lose their compounding power as debt diminishes over time. Periodic refinancing may help you maintain better leverage.

What to do: Build a diversified portfolio that includes a mix of equities, bonds, and income-generating properties. Use tools that provide performance tracking and risk assessment for each asset class.

4. Over-Reliance on Inadequate Retirement Calculators

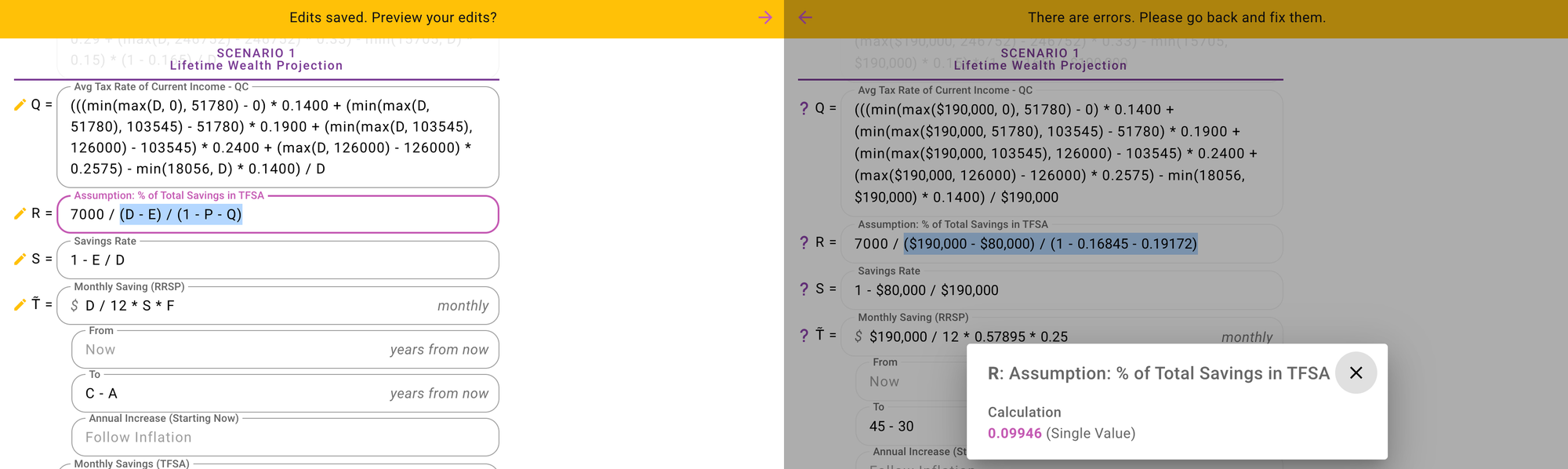

Most brand-sponsored retirement calculators are designed for traditional retirement ages (60 to 65), often overlooking the unique challenges of early retirement. This can result in overly optimistic projections. Even comparing multiple calculators would not solve the issue, as they share similar biases requiring a different approach to overcome.

For early retirement, you need a more advanced approach that reveals the math behind each scenario. Financial independence requires intentional decision-making, which demands clear insights into assumptions and outcomes.

While spreadsheets offer some flexibility, Money Eva greatly simplifies the process with scenario-based modeling and real-time visual feedback. It helps you explore various strategies without the risk of errors, empowering you to make better-informed decisions.

What to do: Use comprehensive tools tailored to your unique retirement timeline. Money Eva allows you to customize inputs, explore side income strategies, and visualize outcomes with full transparency.

Conclusion

Planning for early retirement is rewarding, but it comes with heightened risks. Inflation, reduced pensions, lack of diversification, and inadequate calculators can undermine your financial security. By proactively addressing these challenges and using flexible tools like Money Eva, you can build a resilient plan that adapts to changing circumstances and maximizes your long-term success.